| Name of the fund | Parag Parikh Liquid Fund |

| Investment Objective | To deliver reasonable market related returns with lower risk and high liquidity through judicious investments in money market and debt instruments. (Non Guaranteed) |

| Type of the scheme | An Open-ended Liquid Scheme |

| Date of Allotment | May 11, 2018 |

| Name of the Fund Managers | Mr. Raj Mehta - (Since Inception) |

| Month End Expense Ratio |

Regular Plan: 0.26%* Direct Plan: 0.16%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

| Tier 1 Benchmark Index | CRISIL Liquid fund index |

| Additional Benchmark | CRISIL 1 Year T-Bill index |

| Minimum Application Amount |

New Purchase: ₹ 5,000 Additional Purchase: ₹ 1,000 Monthly SIP: ₹ 1,000 Quarterly SIP: ₹ 3,000/- |

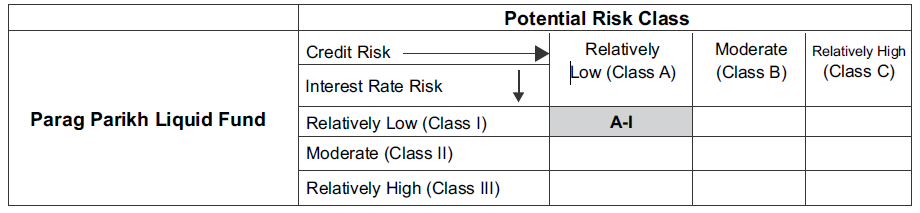

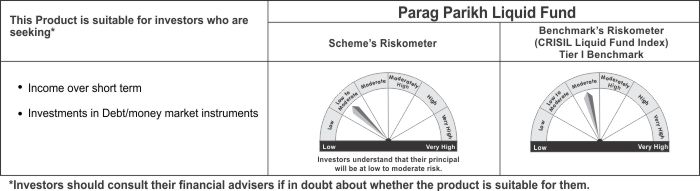

Parag Parikh Liquid Fund

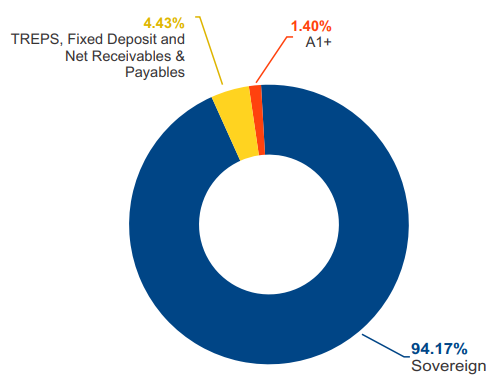

An Open ended Liquid scheme. A Relatively Low Interest Rate Risk and Relatively low Credit Risk.

Factsheet - February 2022

| Assets Under Management (AUM) as onFeb. 28, 2022 | ₹ 1,413.99 Crores |

| Average AUM for the Month | ₹ 1,484.46 Crores |

| Plan | Direct | Regular |

|---|---|---|

| Growth | 1187.8692 | 1183.2279 |

| Daily Reinvestment of Income Distribution cum capital withdrawal option | 1000.5404 | 1000.5404 |

| Weekly Reinvestment of Income Distribution cum capital withdrawal option | 1001.0000 | 1001.0000 |

| Monthly Income Distribution cum capital withdrawal option | 1003.0000 | 1003.0000 |

Dividend History - Monthly Income Distribution cum capital Withdrawal option |

|||||||||

| Record date/ Payout Date | Direct |

Regular |

Regular |

Direct |

Regular |

Direct |

|||

|---|---|---|---|---|---|---|---|---|---|

Retail |

Corporate |

Retail |

Corporate |

Face Value |

NAV per Unit (Ex IDCW) |

NAV per Unit (Ex IDCW) |

NAV per Unit (Cum IDCW) |

NAV per Unit (Cum IDCW) |

|

| 28th Feb. 2022 | 2.8093 |

2.8093 |

2.7340 |

2.7340 |

1,000 |

1,003 |

1,003 |

1,005.7340 |

1,005.8093 |

| 31st Jan. 2022 | 3.2383 |

3.2383 |

3.1426 |

3.1426 |

1,000 |

1,003 |

1,003 |

1,006.1426 |

1,006.2383 |

| 27th Dec. 2021 | 2.5203 |

2.5203 |

2.4428 |

2.4428 |

1,000 |

1,003 |

1,003 |

1,005.4428 |

1,005.5203 |

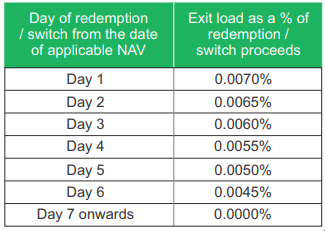

| Entry Load | Not Applicable |

| Exit Load |  |

| * For purpose of levying exit load, if subscription (application & funds) is received within cut-off time on a day, Day 1 shall be considered to be the same day, else the day after the date of allotment of units shall be considered as Day 1. | |

| Average Maturity (Days) | 42.79 |

| Modified duration (Years) | 0.1110 |

| Yield to Maturity | 3.5420% |

| Macaulay Duration (Years) | 0.1147 |

| * Computed on the invested amount | |

Source: Internal sources

Source: Internal sources

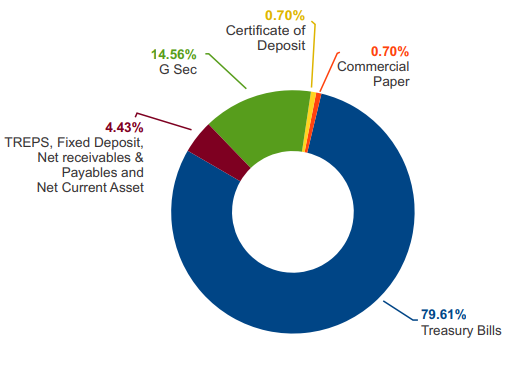

Debt and Money Market Instruments |

||

Name |

Rating |

% of Net Assets |

a) Treasury Bills |

||

91 DAY T-BILL 02-Feb-2022 |

Sovereign |

8.23% |

91 DAY T-BILL 24-Feb-2022 |

Sovereign |

8.21% |

91 DAY T-BILL 03-Mar-2022 |

Sovereign |

8.20% |

91 DAY T-BILL 17-Mar-2022 |

Sovereign |

8.19% |

364 DAY T-BILL 07-Apr-2022 |

Sovereign |

8.17% |

91 DAY T-BILL 21-Apr-2022 |

Sovereign |

8.16% |

91 DAY T-BILL 10-Mar-2022 |

Sovereign |

7.54% |

91 DAY T-BILL 24-Mar-2022 |

Sovereign |

4.91% |

91 DAY T-BILL 28-Apr-2022 |

Sovereign |

4.24% |

182 DAY T-BILL 07-Apr-2022 |

Sovereign |

1.63% |

b) Government Securities |

||

5.09% Government of India 13-APR-2022 |

Sovereign |

7.92% |

8.20% Government of India 15-FEB-2022 |

Sovereign |

6.59% |

| c) Commercial Paper | Housing Development Finance Corporation Ltd. 24-Feb-2022 |

A1+ |

0.66% |

| d) Certificate of Deposit | NABARD 08-Feb-2022 |

A1+ |

0.66% |

| e) TREPS and Other Receivables and Payables | TREPS Including Net Receivables/Payables and Net Current Asset |

16.13% |

f) Fixed Deposits |

||

FDR |

0.56% |

|

Net Assets |

100.00% |

|

Lumpsum Investment Performance (Compounded annual returns) |

||||||

Scheme |

Tier I Benchmark |

Additional Benchmark |

Value of Investment of Rs. 10,000/- |

|||

| Date | PPLF (Regular) |

CRISIL Liquid Fund Index |

CRISIL 1 year T-bill Index |

PPLF (Regular) |

CRISIL Liquid Fund Index |

CRISIL 1 year T-bill Index |

| Since Inception (11 May, 2018)* | 4.52% |

5.42% |

5.82% |

11,832 |

12,226 |

12,401 |

| February 21, 2022 to February 28, 2022 (Last 7 Days) | 3.35% |

3.62% |

0.98% |

10,006 |

10,007 |

10,002 |

| February 13, 2022 to February 28, 2022 (Last 15 days) | 3.40% |

3.84% |

3.43% |

10,014 |

10,016 |

10,014 |

| January 31, 2022 to February 28, 2022 (Last 1 Month) | 3.55% |

3.88% |

6.15% |

10,027 |

10,030 |

10,047 |

| February 28, 2021 to February 28, 2022 (Last 1 year) | 3.18% |

3.65% |

3.65% |

10,318 |

10,365 |

10,365 |

| February 28, 2019 to February 28, 2022 (Last 3 year) | 4.02% |

4.82% |

5.36% |

11,256 |

11,518 |

11,697 |

*Since inception returns are calculated on Rs. 1000 (allotment price)

Note:

Different plans shall have different expense structures.

Scheme returns shown are for regular plan.

Past performance may or may not be sustained in the future.

Greater than 1 year returns are CAGR returns.

Data presented here is upto the last calendar month.

Less than 1 year returns are simple annualised returns.

Total number of units held in