The investment objective of the Scheme is to generate long-term capital appreciation through a diversified portfolio of equity and equity related instruments. There is no assurance that the investment objective of the Scheme will be realized and the scheme does not assure or guarantee any returns.

Rs. 500/- and multiples of Rs. 500/- thereafter

Monthly:

Amount: Minimum Rs. 1,000/- and in multiples of Rs. 500/-

Instalments: Minimum of Six

Quarterly:

Amount: Minimum Rs. 3,000/- and in multiples of Rs. 500/-

Instalments: Minimum of Four

The Net Asset Value is declared at the end of each “Business Day”.

For more information please click here.

Please visit this link

Each investment instalment will be subject to a lock-in for a period of 3 years from the date of investment.

Similar to any Indian equity diversified scheme.

Factsheet and the other details will be available on this website under the 'Schemes' section.

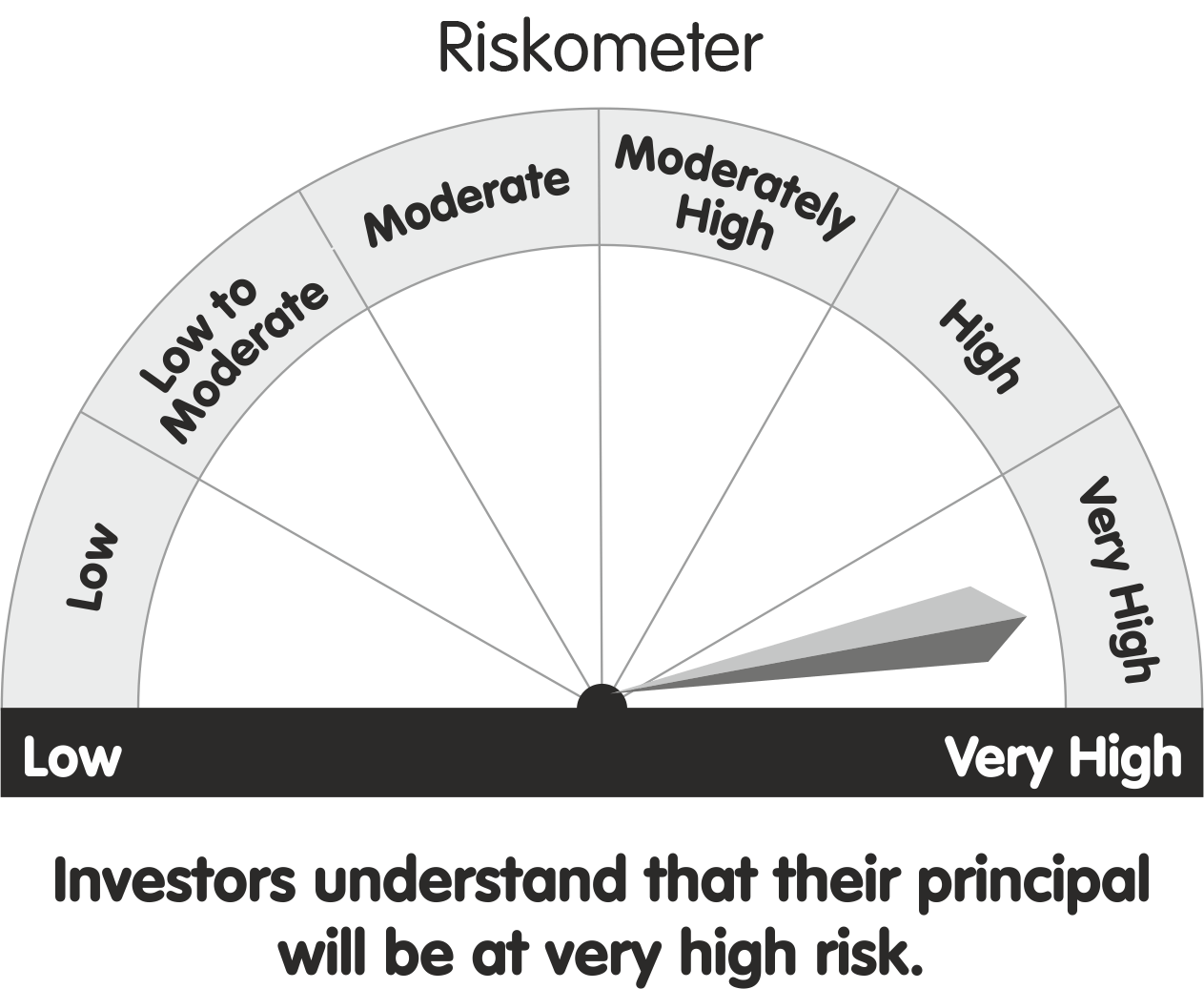

Riskometer This product is suitable for investors who are seeking This product is suitable for investors who are seeking

(I) Long term capital appreciation (II) Investment predominantly in equity and equity related securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. |

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |