|

|

| Reduction in Expense Ratio |

| With effect from the first day of 2017, we have reduced our total expense ratio chargeable to

the scheme, by 20 basis points, to 1.80 per cent p.a. for the Direct Plan and to 2.30 per cent p.a. (exclusive of Service Tax). This will lead to savings of Rs. 20 lakhs per Rs. 100 crores of AUM.

|

|

|

|

| PPFAS Mutual Fund raises its networth to over Rs. 50 crore |

| In compliance with market Regulator SEBI’s stipulation, PPFAS Mutual Fund, sponsored by Parag Parikh Financial Advisory Services Pvt. Ltd. (PPFAS) has raised its networth to over Rs. 50 crore. This has been attained well before the mandated deadline of May 2017.

|

|

|

|

|

|

| Now you can Top-up your SIP in Parag Parikh Long Term Value Fund |

| Bowing to popular demand, we have introduced a Top-Up facility for Systematic Investment Plans (SIPs) in our Flagship scheme, w.e.f. January 10, 2017.

|

|

|

|

|

|

| Renewable energy and electric cars: The way forward |

| Presentation by Rajeev Thakkar at the Financial Opportunities Forum held on December 30, 2016 |

|

|

| There was a time, when mobile technology was in its nascent stage and most were skeptical about its cost effectiveness. Today, many feel the same about electric cars... |

|

|

|

|

|

|

| Around the Blog and Media |

| Articles, blog posts, interviews in the media from last month. |

|

|

| FMCG likely to rebound first from demonetisation hit: PPFAS MF |

| Rajeev Thakkar's interview by Moneycontrol, December 6, 2016 |

| Read More → |

|

|

|

| New Year resolutions for the year(s) ahead... |

| Article by Jayant Pai in Afternoon, December 12, 2016 |

| Read More → |

|

|

|

|

|

|

| Revisiting 'The Granny Rule' |

| Article by Jayant Pai in Networkfp.com, December 15, 2016 |

| Read More → |

|

|

|

| Our CIO, Rajeev Thakkar's tete-a-tete with Ramesh Damani on CNBC TV-18 |

| Rajeev Thakkar's interview by Moneycontrol, December 20, 2016 |

| Read More → |

|

|

|

|

|

|

| A culture of transparency |

| Neil Parikh's interview by valueresearch, December 27, 2016 |

| Read More → |

|

|

|

| Empower managers who take controlled risk |

| Article by Rajeev Thakkar in Mint, December 29, 2016 |

| Read More → |

|

|

|

|

|

|

|

|

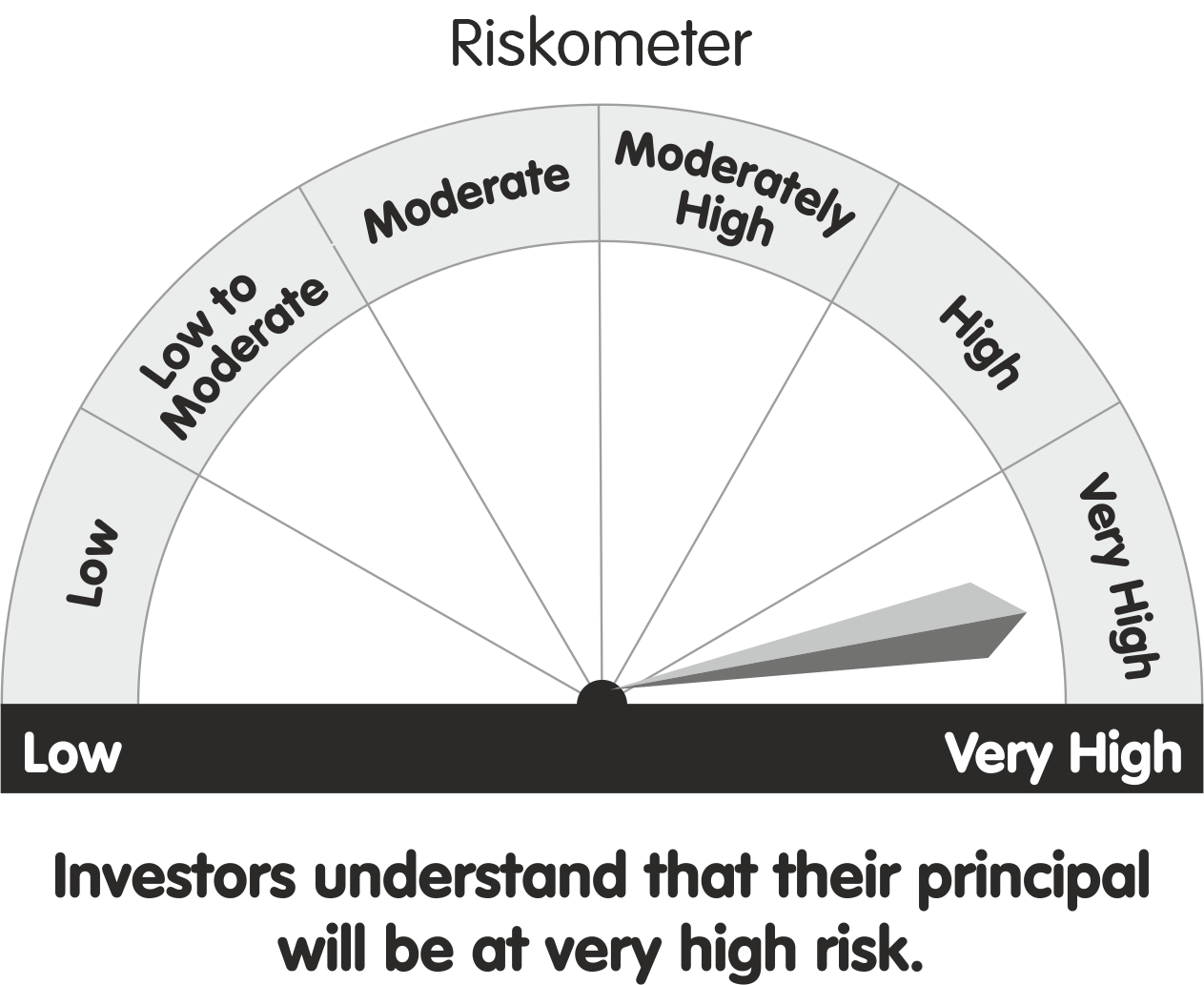

| Riskometer |

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

|

|

|

PPFAS Asset Management Private Limited

Great Western Building, 1st Floor, 130/132, Shahid Bhagat Singh Marg, Near Lion Gate, Fort,

Mumbai - 400 001. INDIA. Tel: 91 22 6140 6555, Fax: 91 22 6140 6590

Investor Helpline:

91 22 61406537

Email: [email protected] Website: www.amc.ppfas.com.

Sponsor: Parag Parikh Financial Advisory Services Limited. CIN: U67190MH1992PLC068970,

Trustee: PPFAS Trustee Company Private Limited. CIN: U65100MH2011PTC221203,

Investment Manager (AMC): PPFAS Asset Management Private Limited. CIN: U65100MH2011PTC220623

|

|