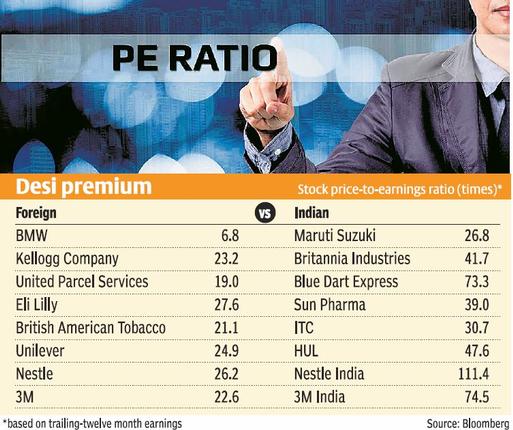

PE ratios of many MNCs abroad have lower valuations than their units here, Indian rivals

From food companies to drug makers, many foreign stocks trade at big discounts to their Indian peers. The Kellogg Company stock quotes at a PE of 23 times on the NYSE vis-à-vis the 42 times of Britannia Industries on the BSE. Ditto for pharma major Eli Lilly, which is available at 28 times against almost 40 times for Sun Pharma.

Stocks of several parent companies abroad also command lower valuations than their Indian subsidiaries. 3M, for instance, quotes at 23 times earnings compared with the 74 times of 3M India. The Nestle stock (26 times) is far cheaper than the Nestle India stock (111 times). So is Unilever (25 times) vis-à-vis Hindustan Unilever (48 times).

So, is it a good idea to invest in foreign stocks that are available relatively cheap? Some investors, including mutual funds, think so. , started by seasoned value investor the late Parag Parikh, invests about a quarter of its portfolio in foreign stocks.

In a recent interview with BusinessLine, Neil Parikh, Chairman and CEO of the fund, explained: “Today, whether it is Accenture, IBM, Cognizant, TCS, Infosys or Wipro, they are in similar businesses. If I like the businesses but feel the valuations here are high, I can invest in markets abroad. Again, with companies such as 3M and Nestle, the parent companies may be trading at lower valuations than the India arms, presenting an investment opportunity. If you are in India, you need to pay for growth. But how much more you pay and what are you comfortable with — these are the questions."

The growth factor

Many, however, believe that the higher valuation of Indian companies is justified given the superior growth potential in India.

“Eventually, the growth opportunity of a company drives its stock valuation. Indian companies generally have higher growth visibility. Besides, companies such as Hindustan Unilever have high return on equity, which helps valuation,” says Dharmesh Kant, Head of Retail Research, Motilal Oswal.

“Then, there is the holding company discount that global entities such as Unilever with entities worldwide suffer,” he adds.

“It is prudent to buy stocks in individual countries. Investing in global holding companies could mean exposure to risks of many countries. Also, there is currency risk; betting on foreign stocks becomes a currency play,” says Kant.

Besides, there may be sector-specific challenges in developed markets. Patents on many pharma drugs have gone off or will do so in the coming years. This could slow growth for pharma companies abroad but benefit India’s export-oriented generic pharma makers.

Exceptions

There are exceptions though to the pattern of foreign stocks trading cheaper than domestic ones. Conspicuous are software and technology stocks. The foreign-based Accenture and Cognizant trade almost at par with TCS and Infosys, and are costlier than Wipro and HCL Technologies.

Kant feels that this is due to the head-start foreign software companies have in the digitisation space, a key growth driver.

Then, there are the tech companies such as Alphabet (earlier Google), Facebook, Apple and Amazon, which do not have comparable listed peers in India.

Most don’t come cheap — Alphabet trades at about 29 times earnings; Facebook quotes at 70 times. But that hasn’t stopped domestic investors from betting on them. has nearly 12 per cent of its corpus deployed in Alphabet.

The original article could be seen here.