The Nifty touching an all-time high has left investors excited. But, several large-cap schemes from top fund houses, such as HDFC, ICICI, Aditya Birla, Reliance and SBI, could still take some time to scale past their peaks seen in January this year. However, the portfolios of some prudent fund managers from smaller fund houses — which looked for secular growth stories and avoided value traps — surged ahead, with the net asset value of their schemes also touching their all-time highs. Higher exposure to some performing stocks in the Nifty, such as Infosys, TCS, HDFC twins and Reliance Industries, has helped these fund houses emerge winners over the past six months. We take a look at four such funds, whose NAVs were at their peaks yesterday:

AUM: ₹4,217 cr 3 year return: 16.58%

Fund Manager: Jinesh Gopani Top 10 holdings (%): 56.2

Top 3 holdings: Kotak Mahindra Bank, HDFC Bank, TCS

Three factors have worked in favour of Axis Focused 25. One, the scheme’s fund manager Jinesh Gopani has focussed on core secular growth stories. In this, he focussed on companies which have high credit rating (AAA). These companies have been naturally blue-chip which to a large extent ensured high growth given their leadership position in respective sectors. Two, he generated alpha by focussing on Initial Public Offerings (IPOs) and some listed companies which have a unique story to tell in a given sector in comparison with their peers. Lastly, he focused on cyclical theme wherein companies embarked on capex cycle. Key companies which have enhanced the scheme’s performance are Bajaj Finance, Endurance Technologies, Bandhan Bank, Gruh Finance and Kotak Mahindra Bank.

AUM: ₹11,07 crore 1/3 year return: 17.98 /13.58%

Fund Manager: Rajeev Thakkar, Raunak Onkar and Raj Mehta Top 10 holdings (%): 43

Top 3 holdings: Alphabet Inc, HDFC Bank, Bajaj Holdings

The fund is a unique offering to investors with its mandate to invest 35% in international companies. Currently the fund has invested 28.1% of its portfolio in companies like Alphabet Inc, Facebook, Suzuki Motor Corp, Nestle and 3M, which has helped it outperform its peers. A stickler to quality companies, reasonable valuations with a focus on key parameters like return on capital, entry barriers, growth prospects has helped fund performance since its inception.

AUM: ₹133 crore 1/3 year return: 15.6 /10.14%

Fund Manager: Bharat Lahoti Top 10 holdings (%): 37

Top 3 holdings: HDFC bank, Reliance industries, Kotak Mahindra Bank

Looking for companies with secular growth stories coupled with sharp portfolio management relative to the benchmark has helped the fund manager deliver superior results over the last one year. The fund also scores by having the lowest expense ratio in the large cap fund category. Decent exposure to stocks like Reliance, HDFC Bank, HDFC, TCS, Infosys, which accounted for a chunk of the Niftys return in the last one year, has helped the has helped the fund beat its benchmark over the last one year.

AUM: ₹1,112 crore 1/3 year return: 9.54 /9.91%

Fund Manager: Siddharth Bothra Top 10 holdings (%): 62

Top 3 holdings: HDFC Bank, Maruti, kotak Mahindra Bank

The fund manager aims to own compact portfolios of quality stocks with secular long-term growth prospects, with low portfolio churn. The fund prefers to restrict its holdings to no more than 25 companies.The fund manager follows a bottom up approach to stock picking and is index agnostic and does not hesitate in taking large concentrated bets in its portfolio. Stocks like HDFC bank, Kotak Bank have helped it outperform.

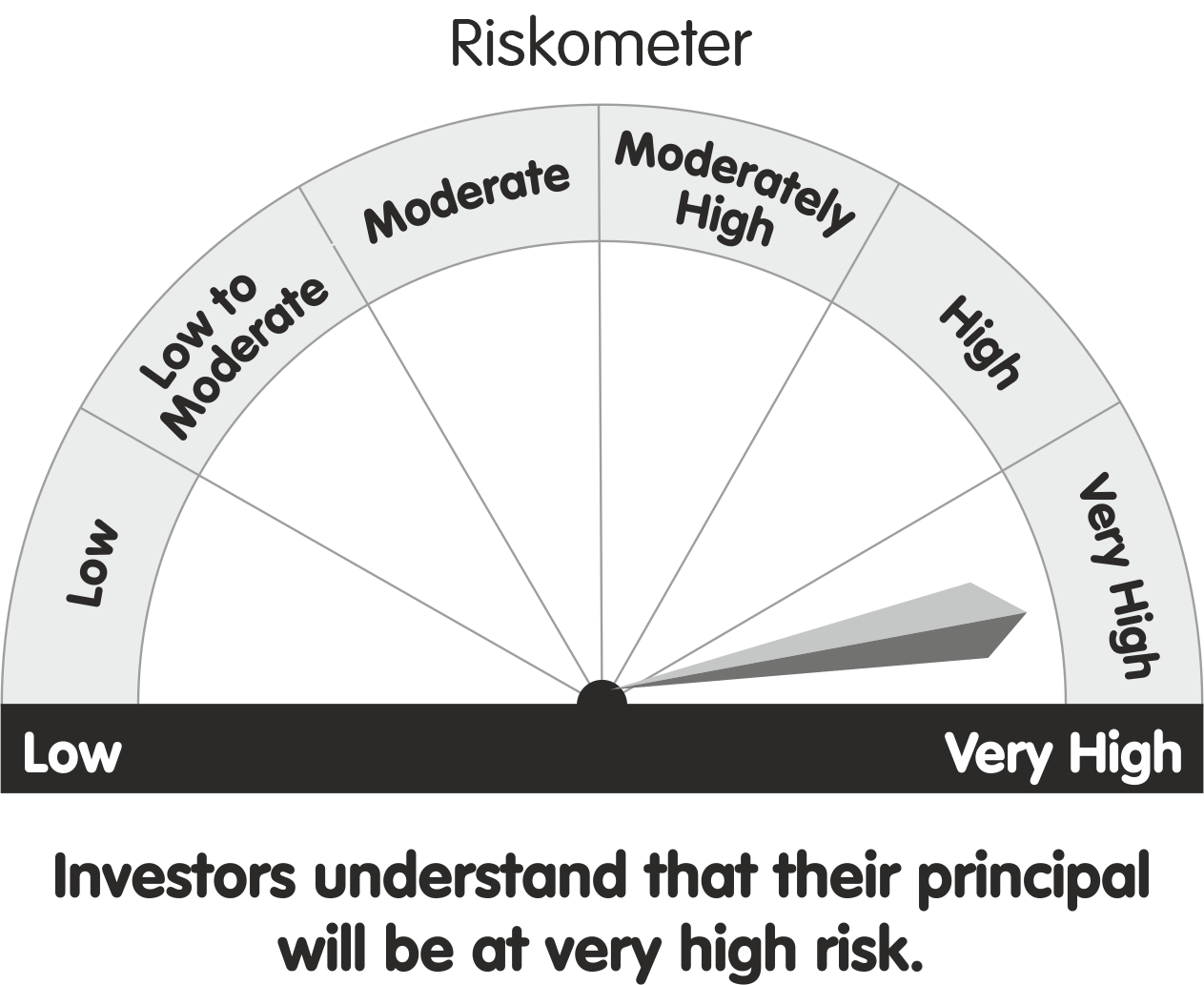

Riskometer This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. Download SID/SAI and KIM here. |