There are differing views on the significance of peak oil theory

Shyamal Banerjee/Mint

Shyamal Banerjee/Mint

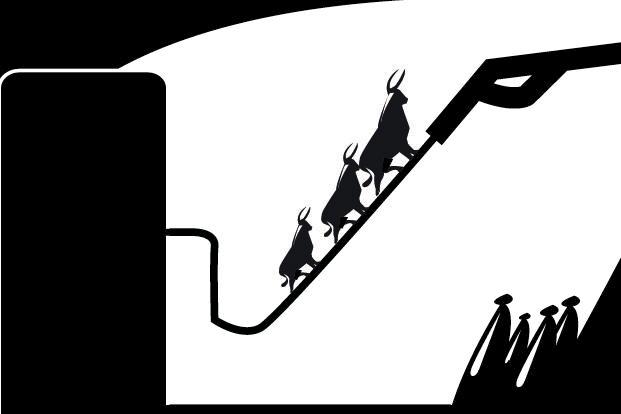

It may be difficult to imagine, but in 2007, when the price of brent crude had touched $150 per barrel, the predominant narrative was of peak oil. For those not familiar with the concept of peak oil, it is a theory proposed by geoscientist M. King Hubbert, stating that the petroleum resources of the world are finite and that there will be a production peak in extracting petroleum resources after which there will be a permanent decline in availability of petroleum products.

There are differing views on the significance of peak oil theory, when peak oil will be reached and the production quantity then. Also, the impact on the global economy is not certain. I am no geologist or scientist. But I am a firm believer in the application of mean reversion and the effect of balancing factors in any economic system. Hence, when oil or commodity prices shoot up relentlessly in one direction, a balancing decline becomes a possibility.

This is not to suggest that the future exactly mirrors the past and that the prices have to come down to the previous mean levels. Far from it. The world is constantly changing and there may be a lot of structural shifts that demand different levels of prices. What mean reversion and balancing loop suggest is that there are countervailing forces that put a brake on a runaway rise (also decline) in prices.

Many may attribute the fall in oil prices to the shale oil and gas revolution in the US. But this argument overlooks the role played by oil prices themselves. When prices shoot up, supply may not go up immediately. New oil wells (shale or conventional) take time to drill and set up. Also, demand may not be elastic in the short run. But if prices sustain at high levels for long, supply does catch up and demand declines.

Even assuming that the peak oil theory is true, at a certain level of price, alternate energy and alternate modes of transportation start becoming attractive. The biggest stumbling block for electric cars, apart from battery technology, may be relatively cheap price of oil.

Shale oil, which has been a reason behind correction of oil prices, may itself be a factor to prevent prices from falling too low. Oil extraction, which is profitable at $150 per barrel, may not be so at $85 a barrel. At lower levels, unviable wells may go out of production leading to a drop in supply. (This may be a good time for India to start thinking about building up strategic petroleum reserves.)

Oil price and investing

How is this relevant to investing? It is always important to keep in mind the volatile nature of energy prices, raw material prices, currency rates, interest rates, inflation rates, economic growth rates and so on. Mindless extrapolation of trends seen in the recent past results in heavy losses for investors. The human mind is prone to seeing patterns where there are none. Even the best of investors like Warren Buffett go astray as can be seen from the losses made by Berkshire Hathaway on its bond holdings in Energy Future Holdings Corp., which suffered a huge write-down on falling natural gas prices.

I came across a statement while talking to an investor this festive season: “Gold and real estate prices never decline in India”. We live our lives based on many such ‘truths’ and it all works fine, until it doesn’t. Among the other things that we blindly believe is that in the longer term, the rupee will always decline against foreign currencies; inflation will always be high in India; gross domestic product growth in the country will always be higher than that of the global economy; our equity market will always do better than global counterparts; company X can never be in trouble with the regulators as it knows how to manage the system; and more.

In fact, a big factor that contributed to the global financial crisis of 2008 was the blind belief in statements like “real estate prices in the US will never come down”.

We will never know what the future will be. But the fewer predictions that an investment plan needs, the better are its chances of success. That’s why I cringe when I see terms such as tactical asset allocation. Asset allocation and financial plans need to be based on the investors’ needs, risk appetite and so on. They should not be about ‘tactical’ timing of the market or impressing the client with the adviser’s ability to forecast.

A Chinese poet and philosopher got it right many centuries ago when he said, “Those who have knowledge, don’t predict. Those who predict, don’t have knowledge”.

The original article could be seen here.