|

|

|

|

|

|

|

|

| This ratio is a statistical measure of a Fund Manager's overall performance in down-markets. It is used to evaluate how well or poorly the Manager performed relative to a specific index during periods when that index has dropped.

|

|

|

|

|

|

|

| Now, empanel with our Fund with just a few clicks. |

|

|

|

| Factsheet » September 2017 |

|

'Gujarat Gas Co Ltd.' ceased to be a part of the portfolio. No new companies were added. Our top three holdings are... Alphabet (10.87%), Bajaj Holdings (7.82%) and HDFC Bank (7.75%). The top 10 equity holdings comprise 56.52% of the core portfolio. These include two stocks listed overseas, viz. Alphabet, and UPS. |

|

|

|

|

|

|

A Discussion on the Pharma Sector |

|

Financial Opportunities Forum held on September 28, 2017 |

|

|

| If you've ever felt the Pharma sector is too difficult to understand, you're probably right. With a lot of moving parts & uncertainty about the future direction, it's tough to guess the fortunes of the sector. |

|

|

|

|

|

|

| Around the Blog and Media |

| Articles, blog posts, interviews and Quotes in the media from last month. |

|

|

| Wondering why FIIs are on a selling spree and DIIs buying? Read this |

| Raunak Onkar's quote in The Economic Times, September 4, 2017 |

| Read More → |

|

|

|

| As stock market heats up, retail investors slake thirst with mutual fund SIPs |

| Rajeev Thakkar's quote in Money Control, September 13, 2017 |

| Read More → |

|

|

|

|

|

|

| Not bothered about caps, we go where opportunity is: Raunak Onkar, PPFAS Mutual Fund |

| Raunak Onkar interviews in ET NOW, September 28, 2017 |

| Read More → |

|

|

|

|

|

|

|

|

|

|

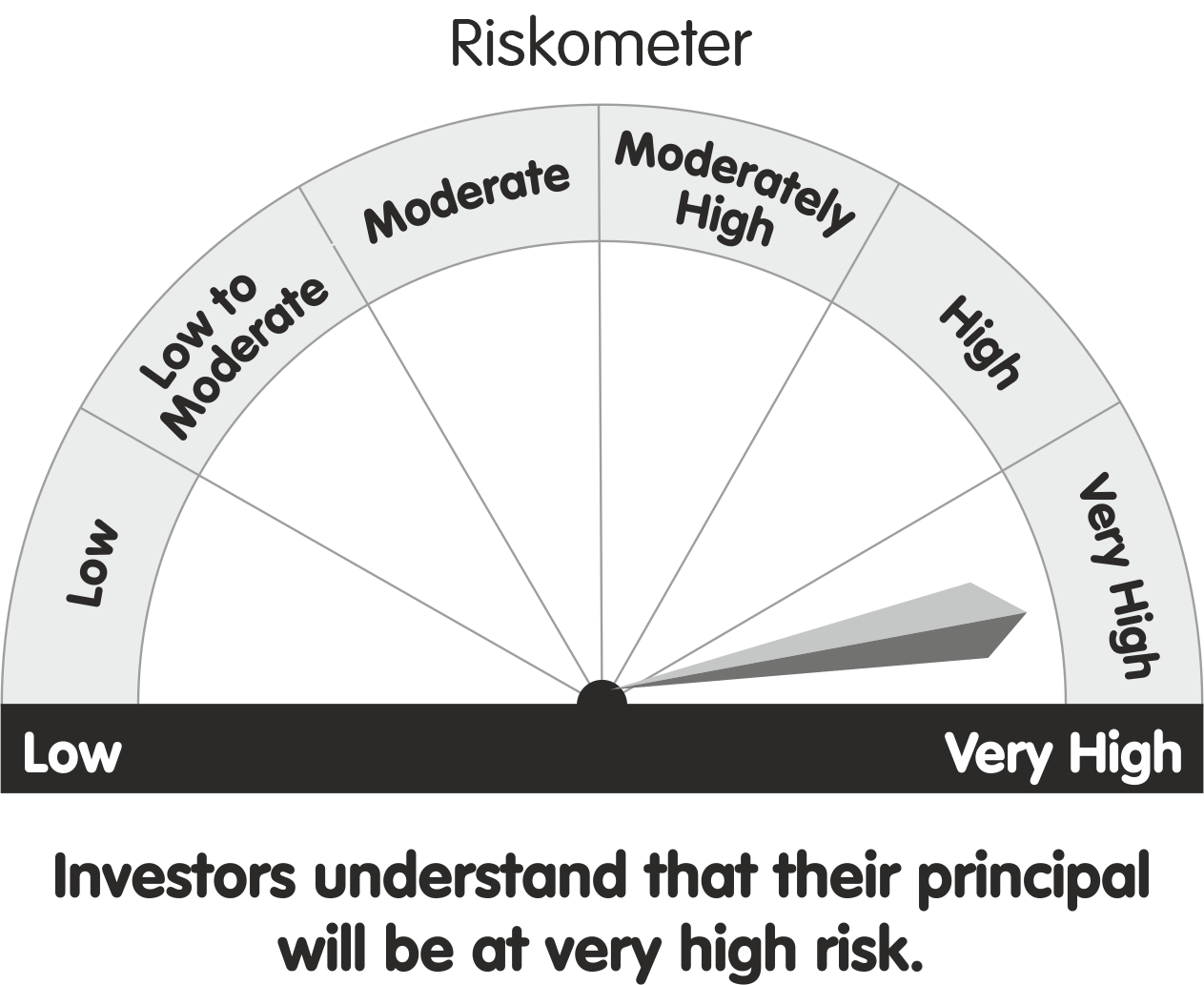

| Riskometer |

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

"It should be noted that views expressed here are based on the information available in the public domain at this moment. Views expressed here can change depending on change in circumstances. Nothing discussed here, constitute a buy/sell/hold recommendation. Views expressed here are in personal capacity."

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

| Download PPFAS SelfInvest |

|

|

|

|

|

|

PPFAS Asset Management Private Limited

81/82, 8th Floor, Sakhar Bhavan, Ramnath Goenka Marg, 230, Nariman Point,

Mumbai - 400 021. INDIA. Tel: 91 22 6140 6555, Fax: 91 22 6140 6590

Distributor Helpline:

91 22 61406538 SMS/Whats App 77770 05775

Email: [email protected] Website: www.amc.ppfas.com.

Sponsor: Parag Parikh Financial Advisory Services Limited.

CIN: U67190MH1992PLC068970,

Trustee: PPFAS Trustee Company Private Limited. CIN: U65100MH2011PTC221203,

Investment Manager (AMC): PPFAS Asset Management Private Limited. CIN: U65100MH2011PTC220623

|

|