|

|

Now you can convert your Distribution Commission in to units of

Parag Parikh Long Term Equity Fund. |

|

|

|

|

|

| Factsheet » June 2017 |

| There is no active change in the composition of the portfolio. Our top three holdings are unchanged... Alphabet (11.38%), HDFC Bank (7.76%) and Bajaj Holdings (6.46%). The top 10 equity holdings comprise 55.10% of the core portfolio. These include two stocks listed overseas, viz. Alphabet, and UPS. |

|

|

|

|

|

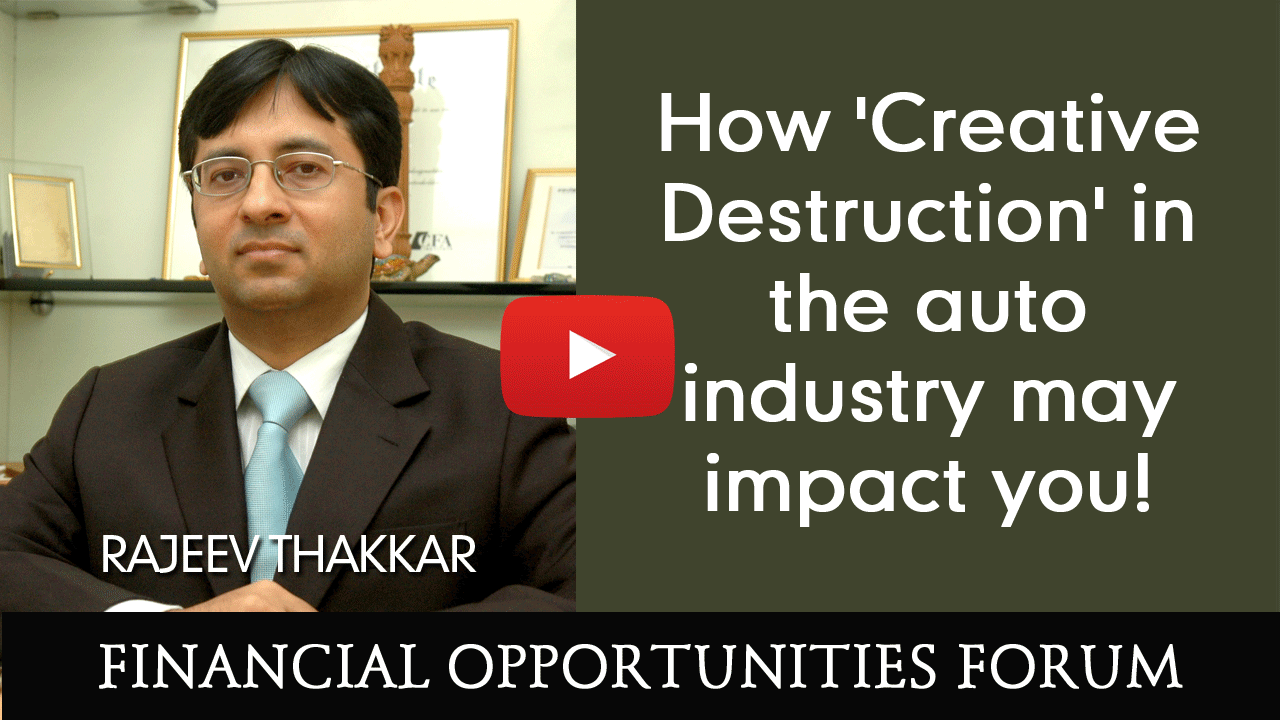

| How 'Creative Destruction' in the auto industry may impact you! |

| Financial Opportunities Forum held on June 6, 2017 |

|

|

| Mr. Rajeev Thakkar talks about Personal Mobility at the latest Financial Opportunities Forum event held in June 2017. |

|

|

|

|

|

|

| Around the Blog and Media |

| Articles, blog posts, interviews and Quotes in the media from last month. |

|

|

| The 'cap' confusion |

| Article by Jayant Pai in Afternoon DC, June 5, 2017 |

| Read More → |

|

|

|

| Mid and smallcaps push valuation multiples in higher band |

| Raunak Onkar interviews in Financial Chronicle, June 5, 2017 |

| Read More → |

|

|

|

|

|

|

| Search for 'value' gets tougher for market investors |

| Rajeev Thakkar's quote in Business Standard, June 16, 2017 |

| Read More → |

|

|

|

| The power of SIP |

| Neil Parikh's quote in Business Today, June 20, 2017 |

| Read More → |

|

|

|

|

|

|

| व्हॅल्यू फंडसच्या माघ्यमातुन व्हॅल्यू इन्वेस्टींगचा अभ्यास |

| Article by Neil Parikh in Matrubhumi, June 20, 2017 |

| Read More → |

|

|

|

| It's tough to find meaningful ideas in this market: Thakkar |

| Rajeev Thakkar interviews in ET NOW, June 23, 2017 |

| Read More → |

|

|

|

|

|

|

| Neil Parikh: In for the long haul |

| Neil Parikh interviews in Forbes, June 24, 2017 |

| Read More → |

|

|

|

| Practising value investing through value-funds |

| Article by Neil Parikh in Andhra Jyothi-(Telugu), June 26, 2017 |

| Read More → |

|

|

|

|

|

|

|

|

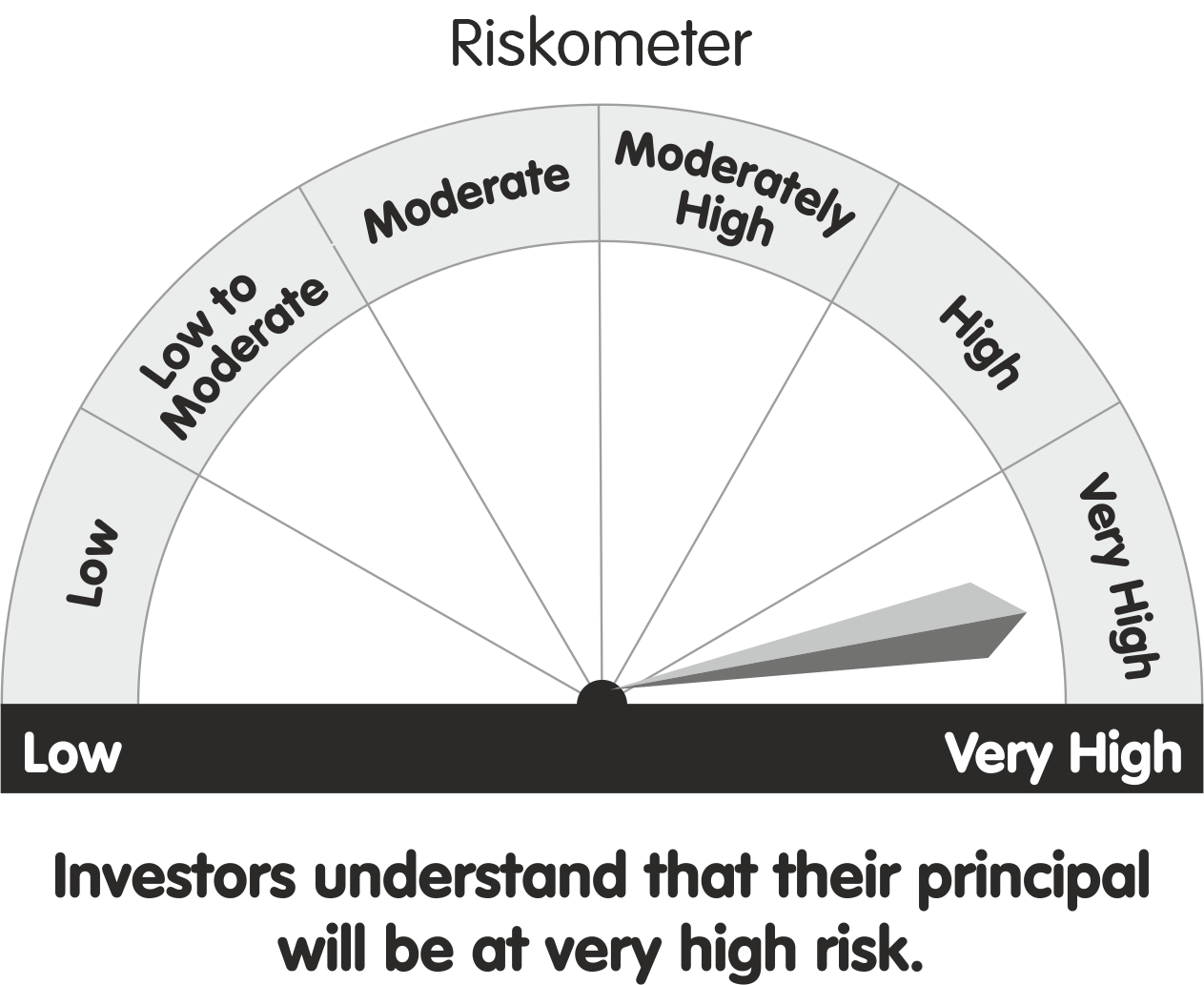

| Riskometer |

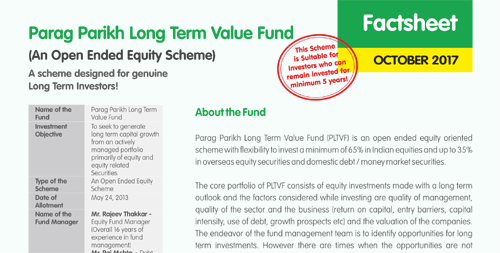

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

| Download PPFAS SelfInvest |

|

|

|

|

|

|

PPFAS Asset Management Private Limited

Great Western Building, 1st Floor, 130/132, Shahid Bhagat Singh Marg, Near Lion Gate, Fort,

Mumbai - 400 001. INDIA. Tel: 91 22 6140 6555, Fax: 91 22 6140 6590

Distributor Helpline:

91 22 61406538 SMS/Whats App 77770 05775

Email: [email protected] Website: www.amc.ppfas.com.

Sponsor: Parag Parikh Financial Advisory Services Limited.

CIN: U67190MH1992PLC068970,

Trustee: PPFAS Trustee Company Private Limited. CIN: U65100MH2011PTC221203,

Investment Manager (AMC): PPFAS Asset Management Private Limited. CIN: U65100MH2011PTC220623

|

|