|

|

|

| Factsheet » November 2016 |

| Dr. Reddy's Laboratories was the only new addition. No stock exited the portfolio.Our top three holdings are... Alphabet (11.78%), Bajaj Holdings and Investment Ltd. (7.23%) and HDFC Bank (6.56%). |

|

|

|

|

|

| We saw this video by Tony Seba |

| Financial Opportunities Forum held on November 30, 2016 |

|

|

| "At November 2016's Financial Opportunities Forum, we saw this video by Tony Seba, titled "Clean Disruption - Why Energy & Transportation will be Obsolete by 2030." |

|

|

|

|

|

|

| Around the Blog and Media |

| Articles, blog posts, interviews in the media from last month. |

|

|

| There is no one country/market that does well all the time |

| Rajeev Thakkar's interview by Hindu Business Line, November 7, 2016. |

| Read More → |

|

|

|

| The Lifeguard Portfolio Manager |

| Rajeev Thakkar's interview by Value Research Mutual Fund Insights, November 2016 |

| Read More → |

|

|

|

|

|

|

| Trump, demonetisation impact: Invest on the basis of data, not speculation about event results |

| Article by Raunak Onkar in The Economic Times - Wealth, November 14, 2016 |

| Read More → |

|

|

|

| Bet on the data, not events |

| Article by Raunak Onkar in The Times Of India, November 21, 2016 |

| Read More → |

|

|

|

|

|

.gif) |

| Assessing risk- appetite is risky... |

| Article by Jayant Pai in Afternoon DC, November 21, 2016 |

| Read More → |

|

|

|

| Local funds' US schemes may gain popularity as Wall Street hits new highs |

| Rajeev Thakkar quote in The Economic Times, November 29, 2016 |

| Read More → |

|

|

|

|

|

|

|

|

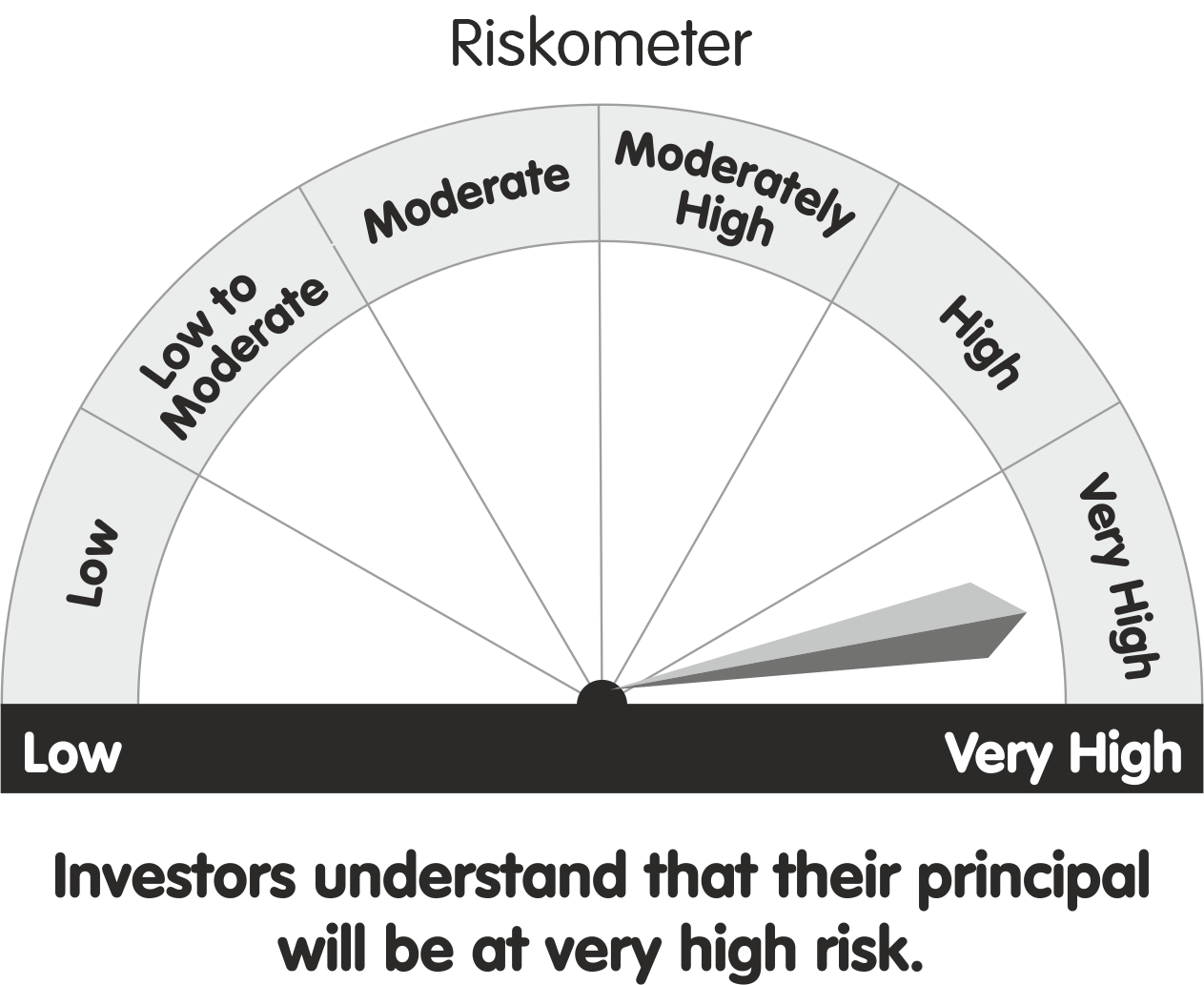

| Riskometer |

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

|

|

|

PPFAS Asset Management Private Limited

Great Western Building, 1st Floor, 130/132, Shahid Bhagat Singh Marg, Near Lion Gate, Fort,

Mumbai - 400 001. INDIA. Tel: 91 22 6140 6555, Fax: 91 22 6140 6590

Investor Helpline:

91 22 61406538

Email: [email protected] Website: www.amc.ppfas.com.

Sponsor: Parag Parikh Financial Advisory Services Limited. CIN: U67190MH1992PLC068970,

Trustee: PPFAS Trustee Company Private Limited. CIN: U65100MH2011PTC221203,

Investment Manager (AMC): PPFAS Asset Management Private Limited. CIN: U65100MH2011PTC220623

|

|